The Department of Labor’s fiduciary rule has officially been delayed. Watch the video to get all the details: As always, we’re here to guide you through these ever-changing times. Don’t hesitate to call with questions or concerns at 800.992.2642. Stay current on all of the latest developments at C1 Insider.

Annuity Sales Director, Advanced Marketing

Stay on Top of Your Game with CreativeOne’s Income Series

Short on time, but crave the latest to stay on top of your game? You’re invited to view our library of powerful webinars where you’ll learn about the latest industry topics at a time that fits your busy schedule! What better way to maximize your time? Take a listen and learn! Income Series 101: Accessing… Read More

Related terms: Agency Building, Annuities, Case Consulting, Practice Management, Sales Notes, Sales Strategies, Savvy Strategies, Training, Uncategorized

Knock, Knock … It’s Opportunity at Your Door

At a time when the current-rate environment is forcing carriers to reduce rates, a unique opportunity has presented itself for producers in Alaska, Connecticut, Delaware, Minnesota, Nevada, Oregon, Pennsylvania, Utah and Washington. What’s the opportunity … the rates on Nine Year New Heights Strategy A got better! How much better? You can now provide your clients 20 percent… Read More

Related terms: Annuities, Carrier Announcements / Updates, Case Consulting, Industry News, Product News, Product Updates, Products & Carriers, Sales Strategies, Savvy Strategies, Uncategorized

Sequence of Returns Calculator Generates Leads

The ability to retire: the ultimate dream Americans spend their whole lives working toward. A time free from financial worry, a time when they’ll be able to do whatever they want, whenever they want … yet market volatility can create a type of risk that can derail an unprepared retirement income portfolio. That risk is… Read More

Related terms: Lead Generation, Marketing, Planning Tools, Practice Management, Sales Notes, Technology / Software, Wealth Management

Keep Up with the Latest Industry News

As an Agent Development Organization (ADO), CreativeOne strives to keep you in the know of the latest industry news, including new products and trends. With our Top Product Snapshot, you’ll gain instant access to this quick reference snapshot that includes: Hot products. Top-product features. Income riders. Carrier ratings. Our Top Product Snapshot makes staying up-to-date… Read More

Related terms: Practice Management, Product Training & Knowledge, Savvy Strategies, Technology / Software

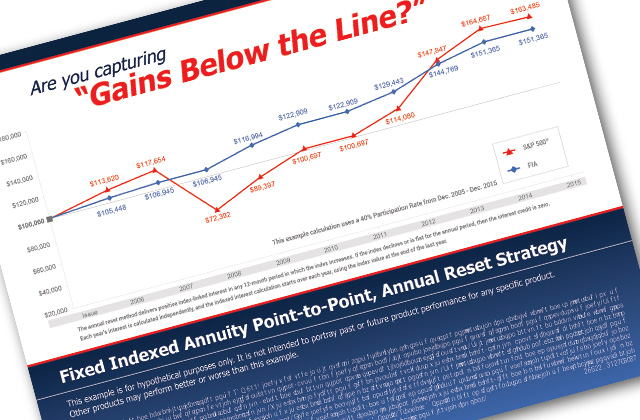

Gains Below the Line: A Conversation on the Strength of the FIA

Do market movements have your clients concerned about their bottom line? What if you could show them a way to capture the gains below the line? One of our most popular presentations dramatically illustrates the value of achieving ‘gains below the line’ with the annual “ratchet and reset” feature of the fixed indexed annuity. Contact… Read More

Related terms: Annuities, Annuity Mechanics, Planning Tools, Product Training & Knowledge, Technology / Software

How Annuities Could Be Transformed with the DOL Fiduciary Rule

On April 14, 2015, the Department of Labor (DOL) issued their long-awaited and hotly debated fiduciary rule. The proposed rule is the department’s latest attempt to protect investors from conflicting investment advice and toughen the standards for advisors working with retirement income. However, many of the details of the new rule are confusing and leave… Read More

Higher Caps for S&P Crediting Strategy

Delaware Life FIAs: Higher Caps for S&P Crediting Strategy Exciting news! Effective February 1, 2016, Delaware Life will be increasing the caps, available in Retirement Stages 7 SM Fixed Index Annuity and Retirement Chapters 10 SM Fixed Index Annuity, for the S&P Annual Point to Point with Cap crediting strategy: Retirement Stages 7 SM … Read More

FGL 3% MYGA Rate Accepting Transfers

3.00% Limited Time Only! FG Guarantee-Platinum® 5 Limited Time Interest Rate Special- Now Accepting Transfers FGL’s 3.00%* interest rate special now includes transfers. This will offer more of your clients the opportunity to purchase our FG Guarantee-Platinum® 5 single premium fixed deferred traditional 5 year annuity. Remember: applications are required to be submitted electronically through our… Read More

Related terms: Annuities, Carrier Announcements / Updates, Industry News, Product News, Product Updates, Products & Carriers, Products & Carriers

Drastic Changes to Social Security to Come in 2016

Big changes to Social Security are set to take effect in 2016. The Bipartisan Budget Act of 2015, passed by Congress and signed into law by President Obama on October 30, 2015, will dramatically impact two Social Security claiming strategies: restricted application benefits and voluntary suspension benefits. These changes are incredibly important to recognize as… Read More